Airports Company South Africa Traffic Performance and Outlook

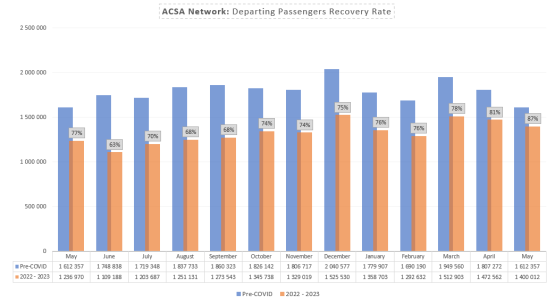

The new quarter of the 2023/2024 financial year started on a positive note, with departing passenger traffic recovering to 81% and 87% of pre-COVID traffic in April 2023 and May 2023 respectively, for the first time since the start of the COVID-19 pandemic. The recent recovery can be attributed to a resilient domestic sector, together with the influence of the easter holiday, new international capacity through new routes providing direct connectivity to new and existing markets, and the MICE travel segment resulting from South Africa hosting multiple global events.

The international market segment has been on a consistent grow trajectory since the. New routes, and route expansions are the largest contributors influencing the international market recovery. International airlines have contributed immensely to the recovery of the international market segment, which currently boosts the highest recovery rate.

ACSA three main international airports collectively account for 85% of all air passenger traffic in South Africa. ORTIA accounts for the majority of traffic within ACSA’s network of airports (49% of the network departing passenger traffic), whilst CTIA continues to boast a high recovery rate (with an overall 80% recovery in departing passengers).

A significant part of the international market recovery is attributed to CTIA, with Europe and North America being the largest contributing source markets. CTIA has recovered its pre-COVID international passenger traffic, with a 102% and 108% recovery in Feb 2023 and Mar 2023 respectively.

Much of Cape Town’s international air traffic was influenced by international MICE, with the region hosting Formula E, Cricket Women’s T20, as well as the International Ice Hockey Federation 2023 Senior Women’s Ice Hockey World Championship. The region has further secured 27 bids for major international events and conferences in 2023.

ORTIA has historically been dependent international traffic, with 42% of the pre-COVID traffic attributed to the international market segment. Currently, 39% of the total traffic at ORTIA is attributed to international traffic. Multiple international routes at ORTIA are yet to be resumed, and this has delayed the recovery of the airport’s. CTIA continues to grow its international traffic segment, with North America, Western Europe and South America being key Source markets driving recovery for the Western Cape region.

Table 1 outlines all foreign airlines currently operating at ACSA, and most International Airlines resumed their services into ACSA’s network. ORTIA has the highest share of foreign airline that currently operate to the airport, with 39 foreign airlines operating to ORTIA, compared to 15 in CTIA and 4 in KSIA.

Across the network, regional inland airports such as Upington, Kimberley and Bram Fischer continue to boast higher recovery rates. The has been a significant reduction in Leisure Air Travel demand because of higher ticket prices. The high inflation and high interest rates environment continues to reduce buying power and hamper consumer confidence. As a result, coastal airports, which are reliant on leisure traffic have lagged in their recovery.

Corporate traffic continues to play a significant role in the recovery of passenger traffic across ACSA’s network of airports (although current level of corporate traffic is lower relative to pre-COVID levels). Tourism remain key to unlock recovery, and domestic regions with low proportions of tourism need to enhance and develop their tourism product, to accelerate recovery.

The domestic market has been steadily recovering, since the grounding of Comair, which resulted in significant capacity losses for the domestic market. The reduced supply of seats, resulted in average ticket price increases across the domestic market, which continues to constrain demand for air travel.

Incumbent airlines such as Fly Safair, Airlink, Fly Cemair, Lift and South African Airways has increased capacity across multiple domestic routes, which had an influence in normalising domestic ticket price. Increases in the domestic average ticket prices peaked in October 2022, with a increase of 47% relative to January 2022. The relative increase was 26% in February 2023.

The JNB – CPT, JNB – DUR and CPT – DUR routes (golden triangle) have seen average ticket price increases of 53%, 1% and 14% respectively.

ACSA airports account for 95% of South Africa’s total airlift capacity, and 99,9% of all international airlift capacity. The ACSA network of airports saw a 33% increase in airlift capacity measured by available seat in the financial year 2022/2023 (compared to the previous financial year). Non-ACSA airports saw a 27% increase in capacity in the 2022/2023 financial year. Attributed to the growth in capacity was the new routes and route expansions, both domestic and international launched by both local and foreign airlines largely into ACSA airports. For ACSA network of airports, the 33% growth in capacity led to a 50% increase in passenger traffic.

ORTIA’s international market recovery has lagged that of CTIA. There is a significant part of ORTIA’s capacity yet to be restored such as direct links to Hong Kong, Brazil. A large part of the existing international route network is operating below pre-pandemic levels (United Arab Emirates, Germany, United Kingdom, United States and China). But recent and expected resumption of services, route expansions and new international routes will add over ~20 000 to ORTIA’s current capacity.

This will reinforce ORTIA hub status and support the international market segment. ORTIA is expected to recover 100% of its pre-COVID international passenger traffic in August 2023. However, deteriorating global economic conditions pose a major down-side risk to the recovery prospects.

ACSA will continue to develop its Global Route Network, by partnering with airline partners (both locally and globally) to enhance connectivity to accelarate recovery, and thereby grow the company’s aeronautical revenue base.

Catalytic projects such as the Single African Transport Market, the African Continental Free Trade Area trade pact will unlock new opportunities for the aviation industry. And as such, Africa is key to unlocking future growth for ACSA. To this end, ACSA aims to develop new routes, with a large focus on route opportunities within the African continent.

Summary

ACSA’s network of airports recovered 72% in FY 2022/23, compared to the previous financial year. Capacity constraints in general within the domestic market has resulted in a flat recovery trajectory for the domestic market overall.

ACSA airports account for 95% of South Africa’s total airlift capacity, and 99,9% of all international airlift capacity. The ACSA network of airports saw a 33% increase in airlift capacity measured by available seat in the financial year 2022/2023 (compared to the previous financial year).

Non-ACSA airports saw a 27% increase in capacity in the 2022/2023 financial year. Attributed to the growth in capacity was the new routes and route expansions, both domestic and international launched by both local and foreign airlines largely into ACSA airports. For ACSA network of airports, the 33% growth in capacity led to a 50% increase in passenger traffic.

Global air traffic recovery continues to improve, underpinned by a resilient airline industry. The Asia pacific region remained closed for much of the FY 2022/23, due to the China’s zero COVID policy. China’s move from a zero COVID policy has seen an accelerated recovery of the Asia-pacific market, which is one of South Africa’s key growth market.

The global oil price decline has led to a decrease in inflation, but recent oil production cuts by the OPEC + members will influence an upward trajectory in oil prices, which will influence an increase in inflation globally.

Globally, higher interest rate and inflation will continue to weaken consumer confidence. This will largely impact the South African air travel market. This will potentially have a negative impact on air passenger traffic and tourism recovery in the 2023/2024 financial year.