Chinese AI Engineers Circumvent U.S. Bans on Nvidia Chips Through Innovative Methods

Despite stringent U.S. export controls aimed at limiting China’s access to advanced semiconductor technology, Chinese AI engineers have found inventive ways to continue using Nvidia’s AI chips. This persistence highlights the ongoing technological tug-of-war between the U.S. and China and underscores the sophisticated methods employed to bypass international trade restrictions.

According to a report from the Wall Street Journal, Chinese engineers have collaborated with brokers and used servers installed with Nvidia’s AI chips, such as the H100, to sidestep direct importation of the banned technology. Notably, Derek Aw, a former Bitcoin miner, facilitated the procurement of over 300 AI servers equipped with these chips by securing investment from the U.S. and Dubai. These servers were subsequently housed in an Australian data center, eventually serving AI projects for a Beijing-based company.

Despite U.S. efforts to tighten controls, including those on chipmaking equipment sold to China, AI firms in the country have reportedly accessed these advanced chips through third-party resellers or by renting Nvidia-powered servers from major tech corporations like Google and Microsoft. This approach indicates a significant loophole in the current export control system, as it involves utilizing cloud services that fall outside direct trade restrictions.

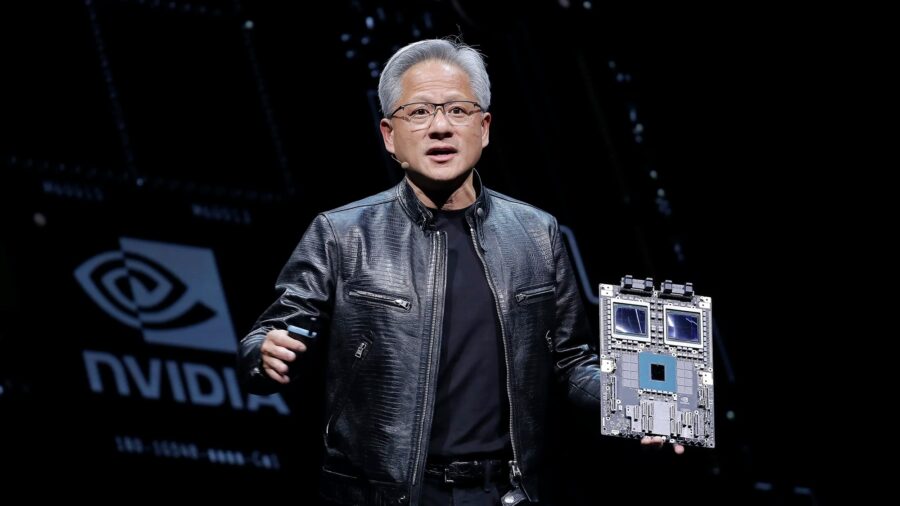

Nvidia, the U.S.-based chipmaker, has attempted to navigate these regulatory challenges by designing chips such as the H20 to align with export controls. However, analysts from Jeffries suggest that further restrictions are likely forthcoming, with potential bans on new models like the H20 during the U.S. government’s annual review of semiconductor export controls scheduled for October.

Moreover, the Biden administration is considering employing the foreign direct product rule to prevent allies from selling advanced chipmaking equipment to China, intensifying the scrutiny of global semiconductor distribution networks.

In response to these challenges, Nvidia is reportedly developing a new version of its Blackwell AI platform, specifically tailored for the Chinese market to comply with U.S. trade restrictions. This version, tentatively called the “B20,” will be launched in collaboration with Inspur, a local distribution partner in China.

Legal experts suggest that the methods employed by buyers, sellers, and brokers to access Nvidia’s AI chips through cloud services do not currently violate any laws, as the trade restrictions primarily apply to direct transactions rather than to the use of cloud-based infrastructure. Nonetheless, the U.S. Commerce Department has proposed new rules as of January to specifically target “foreign malicious actors,” aiming to further restrict their access to U.S. cloud computing resources.

This ongoing scenario reflects not only the technological arms race between the U.S. and China but also the complex interplay of innovation, regulation, and international politics that defines the global tech landscape today.