BMW shares have gained 17% year to date, stealing the buzz from Tesla

The German luxury carmaker is not in the habit of making big statements or trumpeting its achievements too loudly. Its communications strategy can best be described in one word: understated. But if BMW’s share price is any measure of success, the lack of fanfare is working just fine, reported fortune.com.

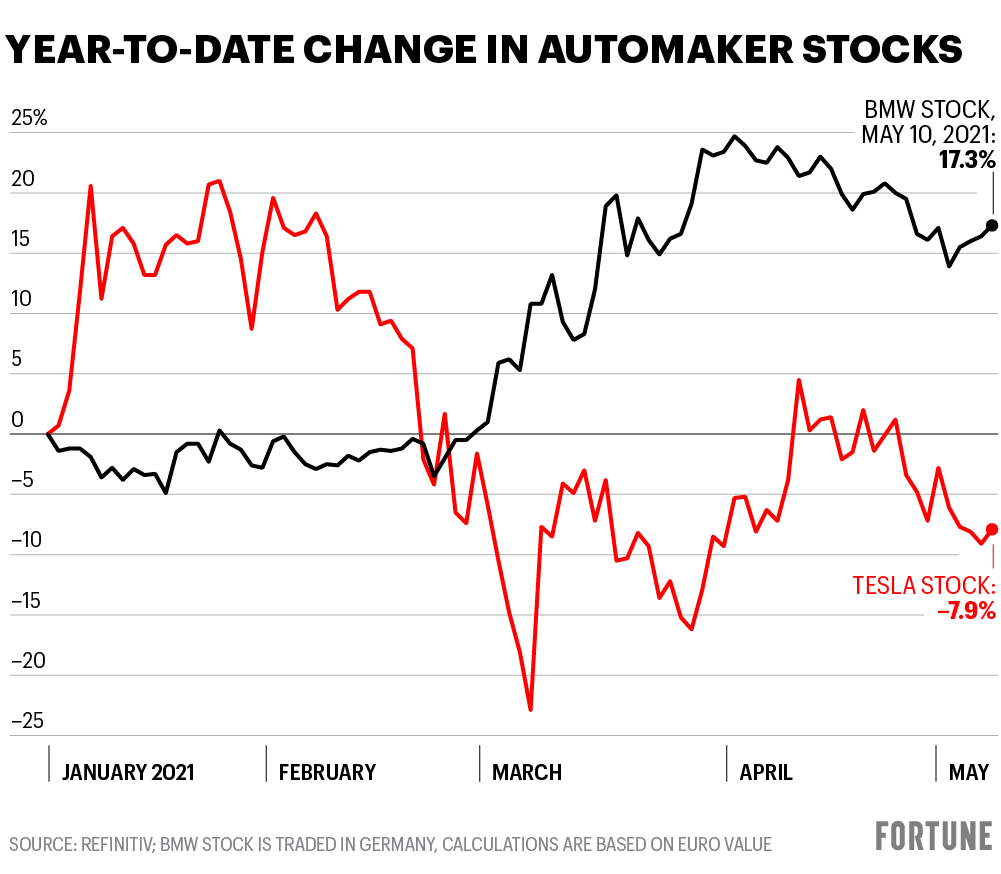

BMW shares have gained 17% year to date, tracking the overall Dow Jones autos index. The stock has enjoyed a renaissance in line with a rotational shift back out of high-growth names like Tesla toward traditional carmakers. Underpinning that growth is BMW’s no-nonsense approach.

“We’re really not a company that looks much at the short-term fluctuations in either direction,” BMW’s finance chief Nicolas Peter told reporters during a briefing at the end of March. “Our performance should convince investors.”

For BMW, there are no ostentatious strategy days like those at Volkswagen, no investor-friendly breakups like that of rival Daimler, and certainly no flirtations with cryptocurrency bulls à la Tesla.With BMW, either you’re in it for the long haul like the two Quandt siblings that together control 46.7% of the equity, or you’re welcome to take the exit ramp.

It’s almost as if BMW hasn’t taken notice of Tesla’s storybook share price surge last year. But even as Tesla and its media-courting CEO, Elon Musk, continue to take up column inches, Tesla’s stock performance in 2021 has been underwhelming, in contrast with BMW’s.

Pure play premium carmaker

BMW has been a pure play premium carmaker for two decades now; its purchase and disposal in 2000 of failing U.K. volume brand Rover permanently soured the board’s taste for grandiose deals.

Shielded from a hostile takeover by the Quandts, the company doesn’t need a high stock price as it generates enough cash from its business to meet any needs.

“We’re able raise the capital we need at excellent conditions to fund our financial services, and that’s a good indicator that debt markets trust our strength. In the core automotive business, we’re able to fund all our important projects from our internal cash flow,” Peter explained.

Instead he emphasized management’s responsibility to its 120,000 employees worldwide during the industry’s decade-long transformation toward automated, zero-emission driving.

Even green bonds, which link favorable conditions to certain eco-friendly investments, were dismissed. While they are all the rage, with rivals Volkswagen and Daimler already tapping investors, Peter rejected green bonds for “putting individual projects on a pedestal for the purpose of marketing.”

For now, at least, BMW’s results suggest its conservative approach continues to pay dividends. Even the worldwide chip shortage did not dent the firm’s performance in the first quarter. Thanks to car sales in China doubling, the operating return at its core passenger car division soared to 9.8% of revenue, well above its target range for the full year.

When asked whether it might consider following Tesla by purchasing Bitcoin or another cryptocurrency—either to broaden payment options for customers or simply to generate a higher return than with low-yielding money market funds—the BMW CFO quickly dismissed the idea.

“I wouldn’t know what additional value that would bring as our existing payment systems work perfectly fine, and as far as an investment is concerned, we have very clear rules in that regard,” he explained.

By Christiaan Hetzner fortune.com