Virgin Galactic shares slipped after the company filed to sell up to $500 million in common stock

Shares of Virgin Galactic slipped on Monday after the company filed to sell up to $500 million in common stock. This follows the commercial spaceflight company’s successful test flight with founder Sir Richard Branson.

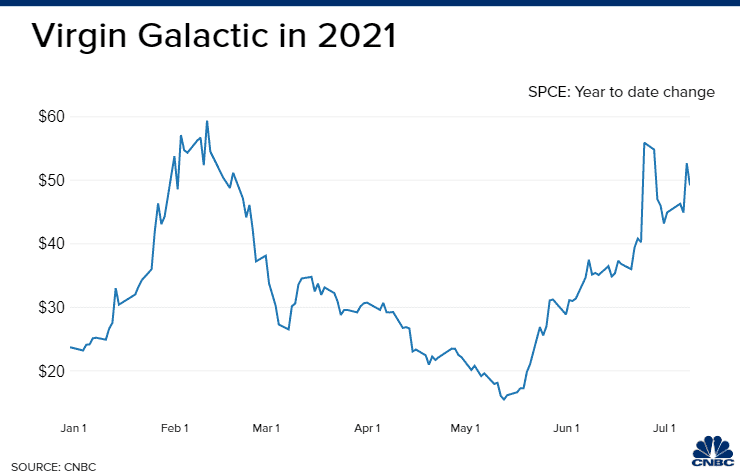

Virgin Galactic, which trades under the ticker SPCE, fell 17.3% after it filed notice of its stock sale offering with the Securities and Exchange Commission. Trading in Virgin Galactic was briefly halted Monday morning due to volatility.

Virgin Galactic has 240 million shares outstanding, of which 164.6 million are available to the public for trading – which is known as float. Based on Friday’s closing price of $49.20, Virgin’s $500 million offering would equate to nearly 10.2 million shares.

On Sunday, the company successfully completed its first fully crewed test flight into suborbital space, a major milestone in the commercial space race and a step toward its goal of commercial service in 2022.

The stock closed at $40.69 per share on Monday, after rising as much as 7% in premarket trading. The stock is up more than 80% so far this year in anticipation of this progress toward commercial service.

“We view Branson’s achievement as a massive marketing coup for Virgin Galactic that will be impossible for the public to ignore,” Canaccord Genuity equity analyst Ken Herbert told clients. The firm has a buy rating on the company, but also placed a $35 price target on the stock, which is below its current level.

The company’s spacecraft, VSS Unity, launched into the skies above New Mexico on Sunday, with two pilots guiding the vehicle carrying the billionaire founder and three Virgin Galactic employees. VSS Unity fired its rocket engine and accelerated to faster than three times the speed of sound in a climb to the edge of space.

“We see this as important on the path toward starting passenger flights, which we assume will happen in early 2022,” AB Bernstein analyst Douglas Harned told clients. The firm has a market perform rating on Virgin Galactic.

Virgin Galactic’s VSS Unity is designed to hold up to six passengers along with the two pilots. The company has about 600 reservations for tickets on future flights, sold at prices between $200,000 and $250,000 each. While passenger ticket sales have yet to be announced, Bernstein expects them to come at a higher price point between $400,000 and $500,000.

Virgin Galactic also announced it is partnering with sweepstakes company Omaze to offer a chance at two seats on “one of the first commercial Virgin Galactic spaceflights” early next year.

“The flight is symbolically important for building consumer confidence in and demand for space tourism,” said Harned. “A successful test flight by Blue Origin including founder Jeff Bezos, scheduled for July 20, should generate further interest in the industry, which would benefit both companies.”

In 2004, Branson founded Virgin Galactic to fly private passengers to space. Branson was not previously expected to fly on Sunday’s spaceflight but after fellow billionaire Jeff Bezos announced he would fly on his company Blue Origin’s first passenger flight on July 20, Virgin Galactic rearranged its schedule — aiming to fly Branson nine days before Bezos.

Launching ahead of Bezos or Elon Musk, Sunday’s flight means Branson is the first of the billionaire space company founders to ride his own spacecraft.

AB Bernstein said the flight’s success and subsequent ticket sales could well be an upward short-term catalyst for the stock but did not change their long-term forecast. The firm did note that it wouldn’t be short the stock, as it has seen huge volatility driven by retail investors reacting to events.

By Maggie Fitzgerald www.cnbc.com