Boeing on Track for Highest Aircraft Deliveries Since 2018

Boeing’s commercial aircraft production is gaining momentum in 2025, putting the U.S. aerospace giant on pace to record its strongest delivery year since 2018. The increase is driven largely by the 737 MAX program, which continues to dominate the company’s output despite lingering regulatory and operational challenges.

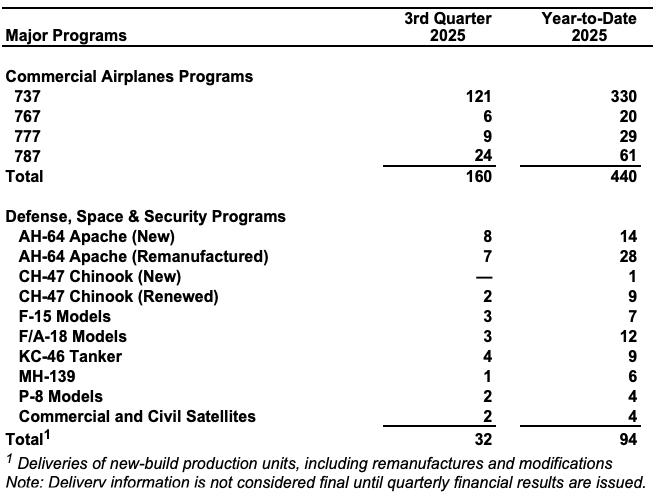

According to Boeing’s latest production data, the company delivered 160 commercial aircraft during the third quarter of 2025, bringing its year-to-date total to 440 aircraft. This marks Boeing’s most productive period since 2018, when it delivered 806 aircraft across all programs. Of this year’s total so far, 330 units are 737 MAX jets, underscoring the model’s crucial role in Boeing’s recovery strategy.

In addition to the 737 MAX, Boeing has delivered 61 787 Dreamliners, 29 777s, and 20 767s in 2025. Major customers include United Airlines and American Airlines in the U.S., along with Ryanair in Europe and Cathay Pacific in Asia, which took delivery of 14 aircraft. Chinese carriers collectively accepted nine Boeing aircraft in August alone, highlighting continued international demand despite trade tensions.

Boeing’s defense, space, and security division also contributed to the company’s overall output, with 32 military and space aircraft delivered in the third quarter and 94 total so far this year. That includes 28 remanufactured and 14 new AH-64 Apache helicopters, six MH-139 Grey Wolf helicopters, and 10 CH-47 Chinooks (one new and nine remanufactured). The company also delivered seven F-15 fighters, 12 F/A-18 strike aircraft, nine KC-46 aerial refueling tankers, and four satellites for commercial and civil applications.

Despite the progress, Boeing remains behind its European rival Airbus, which delivered 507 aircraft through the same period, including 81 in August alone compared with Boeing’s 49. Boeing improved its pace in September, delivering 55 aircraft, its highest monthly output since 2018.

Financially, Boeing continues to face headwinds. According to GuruFocus, the company’s three-year revenue growth rate stands at -1%, with total revenue at $75.33 billion through the third quarter. Its operating margin is -12.45%, net margin -14.18%, and debt-to-equity ratio -16.18%, reflecting ongoing struggles to return to profitability following years of production setbacks, supply chain disruptions, and labor unrest.

Boeing has endured two labor strikes since November, both of which have now been resolved. Still, output remains constrained by Federal Aviation Administration (FAA) limits, which currently cap 737 MAX production at 38 aircraft per month. The restriction was imposed after a January 2024 incident in which an Alaska Airlines 737 MAXsuffered a door plug failure shortly after takeoff in Oregon.

Boeing Chief Executive Officer Kelly Ortberg has pledged to raise 737 MAX production to 42 per month by January 2026, signaling cautious optimism about the company’s operational recovery. If current trends continue, Boeing could close 2025 with its highest production volume in seven years, reaffirming its position as one of the world’s leading aircraft manufacturers—though profitability and regulatory hurdles remain key challenges in the months ahead.

Related News: https://airguide.info/?s=boeing

Sources: AirGuide Business airguide.info, bing.com, yahoo.com, boeing.com