Digital Travel Sales Soar Toward Record $300 Billion Mark

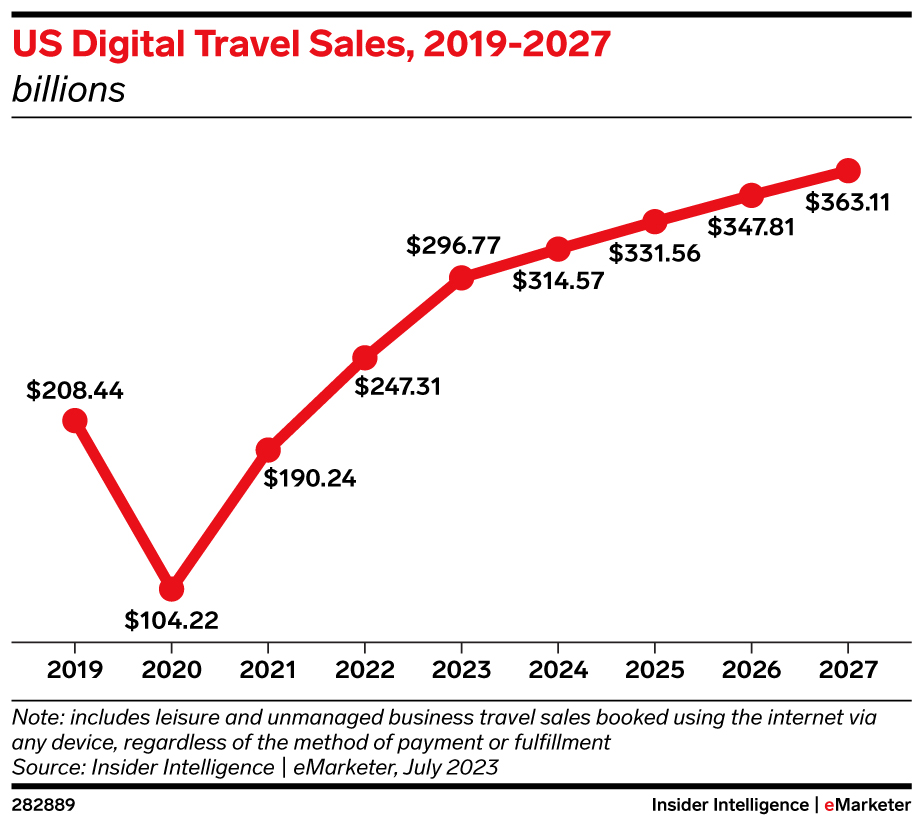

The travel sector emerges as the fastest-growing segment in digital ad spending, showcasing robust growth trends. The domain of digital travel sales* is witnessing remarkable momentum with double-digit surges, effectively surpassing pre-pandemic benchmarks in 2022. In the current year, projections indicate a substantial 20.0% expansion in digital travel sales, reaching an impressive $296.77 billion.

To put this in perspective, sales amounted to $208.44 billion in 2019, experienced a significant 50.0% contraction in 2020, but subsequently rebounded with vigor in 2021 as American travelers resumed their journeys via flights, cruises, and accommodations.

“Digital travel sales are still experiencing a period of exceptional growth, as the rebound from 2020’s historic low continues,” said Ethan Cramer-Flood, principal forecasting writer at Insider Intelligence. “An abnormally large share of digital travel sales growth in the US is going towards international travel this year. This is disproportionately benefiting air carriers, while domestic hotels are seeing a little less of the boom.”

In the previous year, the cumulative online travel sales successfully eclipsed pre-pandemic benchmarks, and in the current year, this cumulative figure is poised to approach the $300 billion mark, a remarkable tripling of the 2020 numbers. With an impressive trajectory, digital travel sales are projected to exceed $350 billion by the conclusion of 2027.

Digital Advertising Spending in the Travel Sector

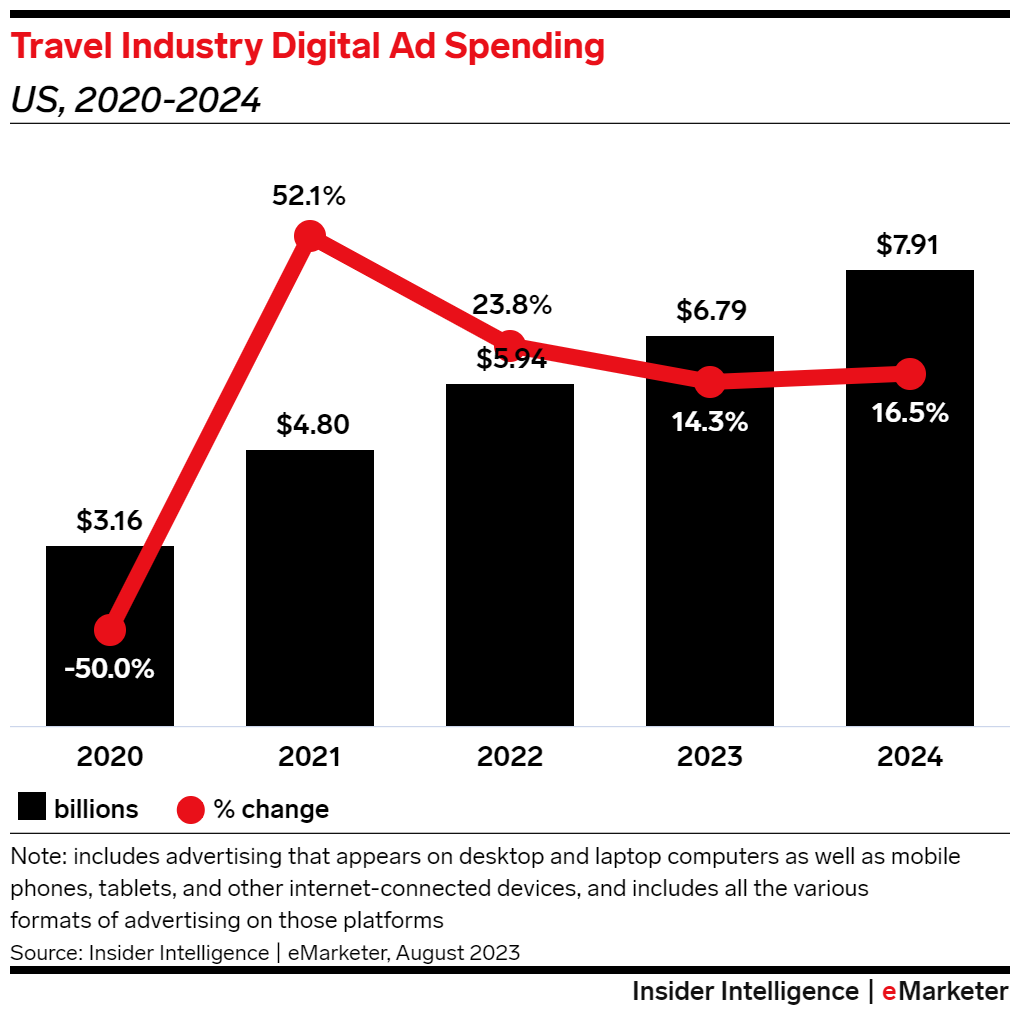

The surge in digital travel sales has triggered noteworthy growth in digital ad expenditure within the sector. After a substantial reduction in spending during the pandemic-induced challenges, the US travel industry has emerged as the most rapidly expanding segment in digital advertising, surpassing overall industry averages. The broader digital ad spending landscape in the US is set to witness a 7.8% increase in 2023. Within this context, the travel sector’s growth trajectory is even surpassing that of retail, traditionally the primary driver of growth in the online advertising arena. Notably, certain sub-categories within the travel sector are poised to amplify their expenditure at an even faster pace.

“Anticipated consumer demand, long constrained, is predicted to sustain travel spending up to 2024,” remarked Oscar Orozco, a forecasting analyst. “In response, travel entities are expected to enhance their digital advertising allocations as competition intensifies among airlines, cruise liners, and online travel agencies vying for market share.”

In the current year, the US travel industry is set to amplify its digital ad spending by 14.3%, outpacing the retail sector’s growth of 12.2%, and reaching a noteworthy $6.79 billion. This surge marks a significant milestone as it surpasses pre-pandemic levels for the first time. In 2019, the industry’s digital ad expenditure amounted to $6.31 billion, a figure that plummeted by a staggering 50.0% in 2020 due to the disruptive effects of COVID-19 on travel bookings. The subsequent gradual recovery of the industry has been mirrored by a rebound in digital ad budgets. Over the upcoming biennium, this trend of double-digit growth is expected to persist, driving the expenditure to a pinnacle of $8.77 billion by 2025, marking the highest level ever attained.

Evelyn Mitchell-Wolf, a senior analyst at Insider Intelligence, noted, “The travel sector places significant emphasis on search advertising, with over half of its ad spending allocated to search formats. Given Google’s commanding presence in the search market, it stands to benefit the most from the growth in travel ad spending. Moreover, Google’s strategic positioning enables it to capture a considerable share of travel display ad funds, thanks to the introduction of targeted tools like Performance Max designed to cater to the objectives of the travel sector.”

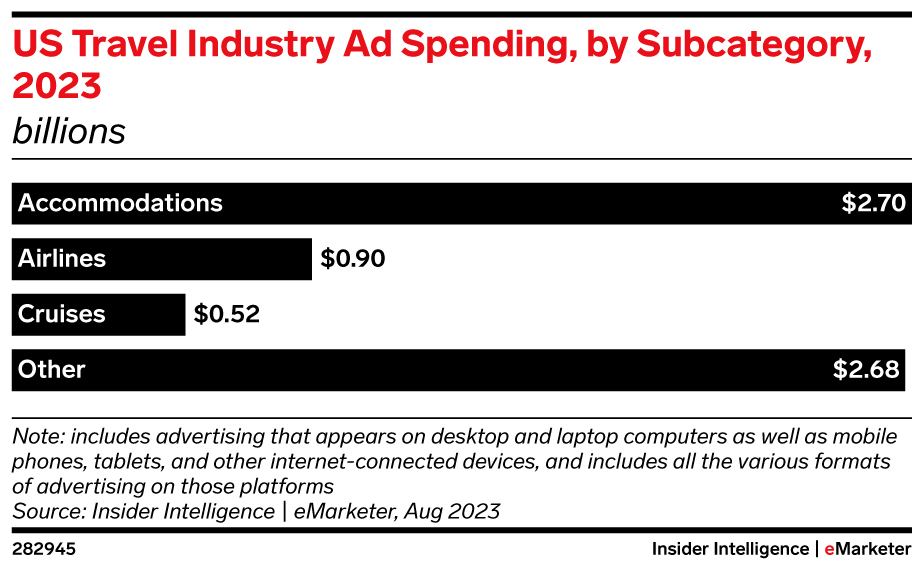

In terms of specific spending patterns within the travel sector, accommodations companies like hotels, Airbnb, and VRBO emerge as the top spenders on online ads. This sub-category is anticipated to witness a 10.9% increase in expenditure, reaching $2.70 billion, constituting 39.7% of the total online travel ad spend. Following closely, the “other” **category, encompassing entities such as tourism boards, online travel agencies (OTAs), travel agents, visitor centers, and car rental companies, is projected to allocate $2.68 billion to digital ads in 2023, reflecting a remarkable 16.5% surge over the figures from 2022.

Airlines secure the position of the third-highest digital ad spender within the travel sector, contributing to 13.2% of the overall travel expenditure. This category also stands out as the fastest-growing, experiencing an 18.1% surge in spending this year, with a total outlay of $895.6 million. Projections indicate that airlines will not only surpass their pre-pandemic 2019 peak spending, but also escalate further to reach $1.09 billion by the following year. This resurgence follows a substantial drop in spending during 2020.

Oscar Orozco, the forecasting analyst, noted, “The resurgence in digital ad spending is being driven by cruise lines, airlines, and online travel agencies (OTAs). With certain top cruise lines achieving occupancy rates exceeding 100%, many are reinvesting their profits into advertising. Airlines are also capitalizing on the current surge in demand for air travel, leading them to expand their budgets. Furthermore, OTAs like Booking.com and Expedia have emerged as go-to platforms for travel enthusiasts seeking accommodations and flight options.”

Lastly, the cruise industry is set to elevate its digital ad expenditure by 14.9% this year, reaching $515.7 million. However, this figure still reflects a notable decline from its pinnacle in 2019, which reached $790.7 million. Forecasts suggest that it may take until after 2025 for the cruise industry’s digital ad spending to surpass that previous high point.

*includes leisure and unmanaged business travel sales booked using the internet via any device, regardless of the method of payment or fulfillment

** tourism boards, destination marketing organizations, travel bureaus, country clubs, OTA’s, travel agents, travel websites, visitor centers, car rental companies and leisure and unmanaged business travel.

Methodology

Insider Intelligence forecasts and estimates are based on our proprietary analysis, and include both quantitative and qualitative data curated from public companies, government agencies, research and media firms, and interviews with expert executives in relevant fields. We regularly re-evaluate available data to ensure our forecasts reflect the latest business and economic developments and trends.

Source: Insider Intelligence

Insider Intelligence is a leading research provider focused on digital transformation. We empower professionals with actionable data, insights, and analysis to make informed decisions in a digital world. Formed as a merger of eMarketer and Business Insider Intelligence in 2020, we produce nearly 200 forecasts, 300 reports, 7,000 charts, and 1,500 newsletters across the Advertising, Media, and Marketing; Financial Services; Healthcare; and Retail and Ecommerce industries. Insider Intelligence is a division of Axel Springer S.E.