Rolls-Royce sees the widebody aircraft market rebounding faster than expected

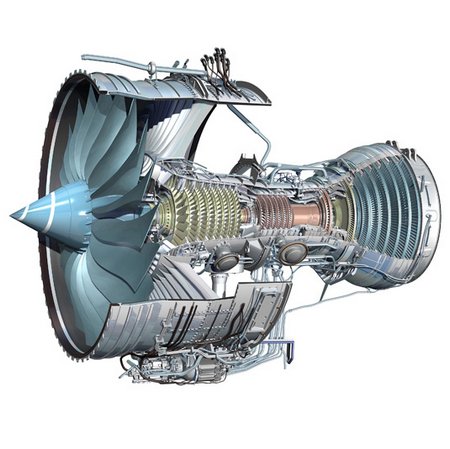

Rolls-Royce Trent engine for Boeing 787

British jet-engine maker Rolls-Royce Holdings Plc sees the widebody aircraft market rebounding faster than expected.

The long-haul market that Rolls-Royce services was hardest hit by the pandemic but recently there have been some signs of a pick-up in sales talks. Chief Executive Officer Warren East said the company is discussing future production planning and rates with aircraft manufacturer Airbus SE.

“We’re seeing a definite tick up in widebody activity,” he said at a media event. “We see demand coming the other side of 2025 but airlines are starting to think about it now.”

The pandemic dealt a harsh blow to Rolls-Royce’s business selling and maintaining long-haul jet engines. Despite a recent rebound, international travel continues to lag behind the short-haul market, though there have been reports of airlines eyeing new orders for large jets in recent weeks.

Rolls-Royce is the sole engine supplier for Airbus A350s and has a 35% market share on the Boeing 787. Civil Aerospace President Chris Cholerton said he sees scope for A350 production rates to go higher faster, with some “potentially quite big” widebody campaigns set to be decided. Airbus currently plans to raise its A350 production rate to six a month in early 2023 from five.

The UK company also hopes to gain market share on the 787, after problems with its Trent 1000 engines led to a loss of customer confidence. Rolls-Royce is still making the final two fixes on the Trent 1000, Cholerton said, with one set to be certified by the end of the year but the other, a tweak to the high-pressure turbine blade, delayed into next year on certification hurdles.

Even if long-haul travel recovers faster than expected, Rolls-Royce faces challenges in returning to profitability. The company is set to be cash-positive this year, though that will involve a figure in the “small, single-digit hundreds of millions,” said East, who’s set to leave at the end of the year.

https://www.bloomberg.com